Fresher’s Roadmap to Becoming a Skilled Financial Analyst

Table of Contents

Learn how to become a financial analyst step by step. Explore skills, tools, certifications, and data analytics courses for freshers.

Introduction

The demand for financial analysts continues to increase with the increasing use of financial decision-making based on financial data. Investigations have highlighted that more than 70% of companies use financial data analytics for the determination of the best investment and budgeting strategies, increasing job prospects for fresher candidates. However, fresher candidates are confused about the strategies to adopt and the necessary requirements for this profession.

The blog will explain a step-by-step process related to becoming a financial analyst, especially designed for beginners and freshers. You will learn about the importance of a financial analyst, the required skill set, tools, ways of getting certified, Structured learning, builds practical skills step by step, helping us to apply knowledge effectively for career growth.

What Does a Financial Analyst Do?

The role played by a financial analyst in helping the company understand its financial position and come up with effective business decisions cannot be overstressed. The first major duty performed by these types of analysts in the company is to analyze and review various financial information such as income statements, balance sheets, and cash flow statements. By doing this, they help in identifying possible trends and risks that could potentially influence the company in some way. A financial analyst adds value to the company financially by trying to forecast future outcomes based on information obtained in the past; for example, they use statistics to forecast future gains or expenditures for a business. In these cases, they analyze different investment options for spending or saving money.

For a financial analyst in a day-to-day work scenario, they may examine quarterly sales reports to determine if a company is achieving its objectives. It also enables the analyst to compare the data from the external environment with that of the company to understand the external factors’ contribution to the company’s performance. To work as a financial analyst, one needs to possess strong knowledge in understanding various scenarios through the construction of models.

Understanding the Financial Analyst Role

To understand the role of the financial analyst, including the function of the position within the organization, one must also understand the factor of communication. Financial analysts deal with figures as high as the millions, which to many people can be confusing. One of the purposes of the position is to make complicated information simple through the offer of reports or other forms of presentation.

Problem-solving skills are another highly required skill in this field. They must analyze what is shown in the data in terms of problems or opportunities and what these numbers really mean in terms of solving problems to further enhance the business to attain desired results.

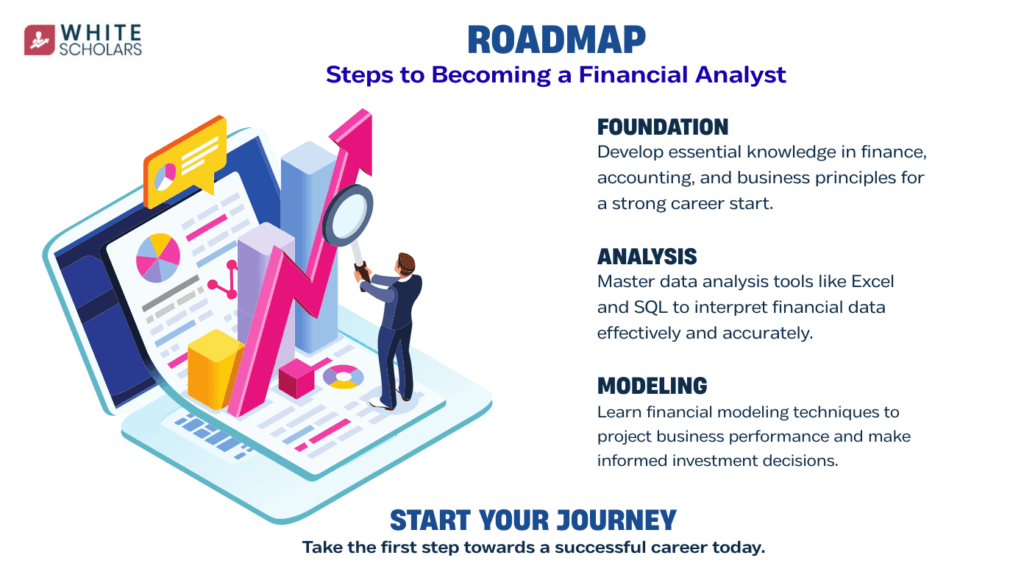

Roadmap to Becoming a Financial Analyst

Becoming a financial analyst is not an overnight task; it demands an appropriate roadmap of learning involving technical know-how and its marriage with the subject of finance. Without an appropriate plan of how to learn the subject and how each of the technical know-how required integrates into the subject of finance, the beginner can easily be confused as to where to start from.

For freshers and those interested, the journey usually starts with learning; it all begins with learning basic concepts of data and finance. It requires us to learn how to work with numbers correctly and understand financial reports and business data. It is also normal to find people taking up a course or learning to become a data analyst without knowing about it in detail. We should know that involves practical learning rather than just theory. These programs focus on practical learning, where students work with real datasets instead of only theory.

Through such training, the basics of computer applications such as Excel, simple SQL knowledge, interpretation of data, and basic financial calculations should be understood by the beginner. This will help in better understanding of the practical applications of the use of data within the business environment. As the beginner becomes more expert, the training soon provides the individual to eventually become one with financial data and be closer to the role of a financial analyst.

Foundation: Building Core Knowledge

This is the foundation stage, the starting block that any individual needs to begin with if they want to become a financial analyst. It is at this stage that the most important thing is the development of a strong understanding of the main financial ideas that are being discussed. This involves understanding how money works in a company or any other organization, including how a company makes or spends money. Knowledge about income statements or balance sheets is also crucial in understanding the position of the company.

Aside from the money knowledge, one also needs to learn the basics of businesses. This includes understanding the various departments that work in a company, the decision-making processes, as well as the impact of the market on the performance of a company.

Data analysis skills are also taught to the students at the foundation level along with finance and business knowledge. Students get to practice dealing with numbers by arranging them appropriately and identifying patterns among such data. Analyzing any kind of data related to finances with the help of software such as Excel is done for students to understand finances accurately without any mistakes. A strong foundation will help a financial analyst easily understand new tools and advanced techniques adopted in the subsequent steps in their career.

Phase 1: Learning Data Analysis Tools

Several tools for data analysis make up the backbone of a financial analyst’s routine activities. Excel, SQL, Python, and R are some of the tools that are widely applicable for financial analysis. Excel is widely applicable for spreadsheet financial analysis and financial modeling, and SQL helps in the retrieval of financial data from databases.

Newcomers can be initiated into the use of such tools through the structured programs for learning, like data analytics coaching in cities like Hyderabad, Mumbai, Bangalore etc.

Tools Used in Financial Analysis

Tools for information visualization, including Tableau, allow the financial analyst to present complex data in a clear, non-technical way using data visualizations. This way, the analyst does not need to explain the complex information presented in the table, as he/she can present a clear view using the tools. This makes it possible for the manager or the person concerned with the decision-making process to clearly grasp the information through the use of the tools. This makes the explanation clear.

Phase 2: Advanced Data Analysis Skills

Once one understands the general tools, the next significant step is learning advanced skills concerning data analysis. In this area, the financial analyst is equipped with knowledge on how to develop a financial model, one that can be employed to forecast future business activities. In doing so, one is required to study some of the historic financial data concerning patterns. Analyzing all the data can be beneficial in predicting revenue, expenditures, and profits.

Advanced analysis extends beyond simple reporting. A prime focus is on predictions, helping in business planning. Applying learning skills to practical data analysis is an added advantage. Working on projects allows students to exercise learning through real data, business scenarios, testing, investing, and expressing results professionally, helping them to gain confidence to tackle real-world requirements.

Practical Application Through Projects

One major reason that the practical application through projects is essential in the study of financial analysis is that the student can relate the theoretical concepts with the practical problems through projects. Students can apply the concepts that are being studied practically rather than merely studying the theory. Real datasets about different financial situations are used rather than imaginary data.

These courses of work allow a student to develop and practice working on various financial models that demonstrate potential results in a business environment. Through these courses of work, a student will also learn to assess different investment opportunities by considering risks and returns using different sets of numbers in their finances. Final projects involve various forms of knowledge to be implemented in a course of work, say financial modeling, analysis, and visualization. Through these courses of work, a student is required to present their findings in a professional way, as in a real-world scenario.

Phase 3: Certifications and Career Growth

Certifications also assist in the validation of knowledge and improve the chances of a successful career. Some such certifications include CFA (Chartered Financial Analyst), FRM certification, and CPA (Certified Public Accountant) designation. They add strength to the knowledge and are important while moving into a career as a financial analyst.

Freshers can benefit from this combination of certified courses in data analytics with courses in certification.

Choosing the Right Certification Path

Selection of choices under various certifications is dependent on individual goal formulations. CFA (Chartered Financial Analyst) is best suited for investment management; on the other hand, FRM (Financial Risk Manager) is best suited for risk analysis jobs. Proper planning is necessary to guarantee high pass results.

Tips for Success as a Financial Analyst

Success in a financial analyst profession depends on being a “lifelong student.” For example, industry trends in a financial analyst profession tend to change quickly. Another factor in a financial analyst profession is networking opportunities and being updated in terms of industry insights and available opportunities.

Good communication abilities also allow analysts to clearly explain complex data findings. More and more employers are looking to recruit individuals with professional and interpersonal abilities like analytical and teamwork capacities.

Common Mistakes to Avoid

- Failing to focus on the applications of the theoretical knowledge acquired will make it hard to perform adequately in the real workplace scenarios.

- There is a limitation to the ability to know the concept of working financially by avoiding hands-on projects.

- Forgetting about data visualization skills can result in the difficulty of explaining data.

- Lack of effective communication skills means the analyst may not clearly communicate his or her conclusions to decision-makers.

- A balanced plan including theory, skills training, visualization, and communication can help in long-term career success.

Conclusion

To become a financial analyst as a beginner or a fresher, a clear path is needed, requiring constant efforts, proper exposure, and a strong foundation in analyzing data. familiarity with software like Excel, SQL, Python, Tableau, and Power BI, alongside knowledge gained through a certification course.

The appropriate amount of theory and practical knowledge can be obtained by pursuing data analytics certificates from coaching centers in Hyderabad. Through continuous learning and training, the aspirants can confidently enter the industry in the field of finance.

FAQs

1. Can a fresher become a financial analyst?

Freshers can look forward to becoming financial analysts if they can develop skills in data analysis and financial modeling. In this way, the experience gap can be filled. The entry-level jobs offer an opportunity for gradual skills development.

2. What are the skills needed for a financial analyst?

It must be emphasized that a financial analyst must have skills relating to data analysis and financial models, along with proficiency in using technologies like Excel, SQL, Python, Tableau, and Power BI. On the other hand, communication skills and problem-solving skills must also be present, which facilitates the process of decision-making.

3. How does a data analytics course help financial analysts?

A data analytics course in cities like Mumbai, Hyderabad, and Bangalore helps the financial analyst in understanding data handling, visualization, and interpretation that will be directly applied in financial reporting and forecasting. Also, practical exposure enhances job readiness.

4. Which certification is best for a financial analyst?

CFA is preferred on most occasions in investment-related roles, while FRM plays its role in risk management. CPA will support the career path in accounting-related profiles. The selection of certification depends upon long-run and future career objectives.

5. How long does it take to become a financial analyst?

The timeframe for this varies, with beginners requiring between 6-12 months to achieve foundational knowledge. There may be additional time involved for Certification preparation. Continuous learning supports career progression.